European Venture Report: VC Dollars Rise In 2019

Gené Teare and Sophia Kunthara for CrunchBase News

Venture capital deals in the United States and China tend to get the most attention, but VC dollars flowing to Europe have quietly been on the rise.

According to Crunchbase data, over $122 billion has been invested in European startups, across 48 countries, in the last five years.

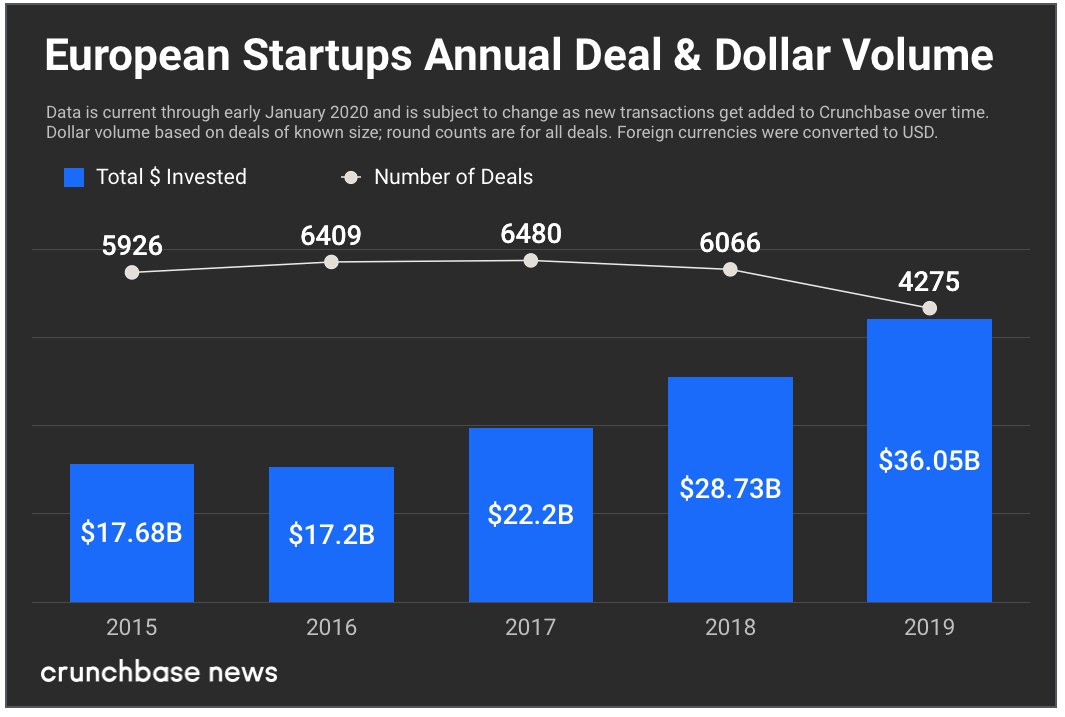

And 2019 is a record year for European startups with companies raising over $36 billion–a five-year high, and over $7 billion more than European startups raised the previous year. Year-over-year growth tracks at 25 percent. Since 2015, the amount of money raised by European startups has more than doubled.

Strong European growth in 2019 contrasts with our reporting on overall global venture, which is down year over year (largely based on China late-stage fundings slowing down in 2019). For the U.S. and Canada, invested dollars are projected to grow at a small percentage. It is worth noting that 2018 was a peak for global venture funding over the last 10 years and grew 47 percent year over year from 2017 to 2018.

Both our global and North American reports use projected data in order to overcome reporting delays. With our European report we look at reported–not projected–data, which means that 2019 numbers will increase over time, relative to previous years. We also excluded private equity and corporate rounds for this report.

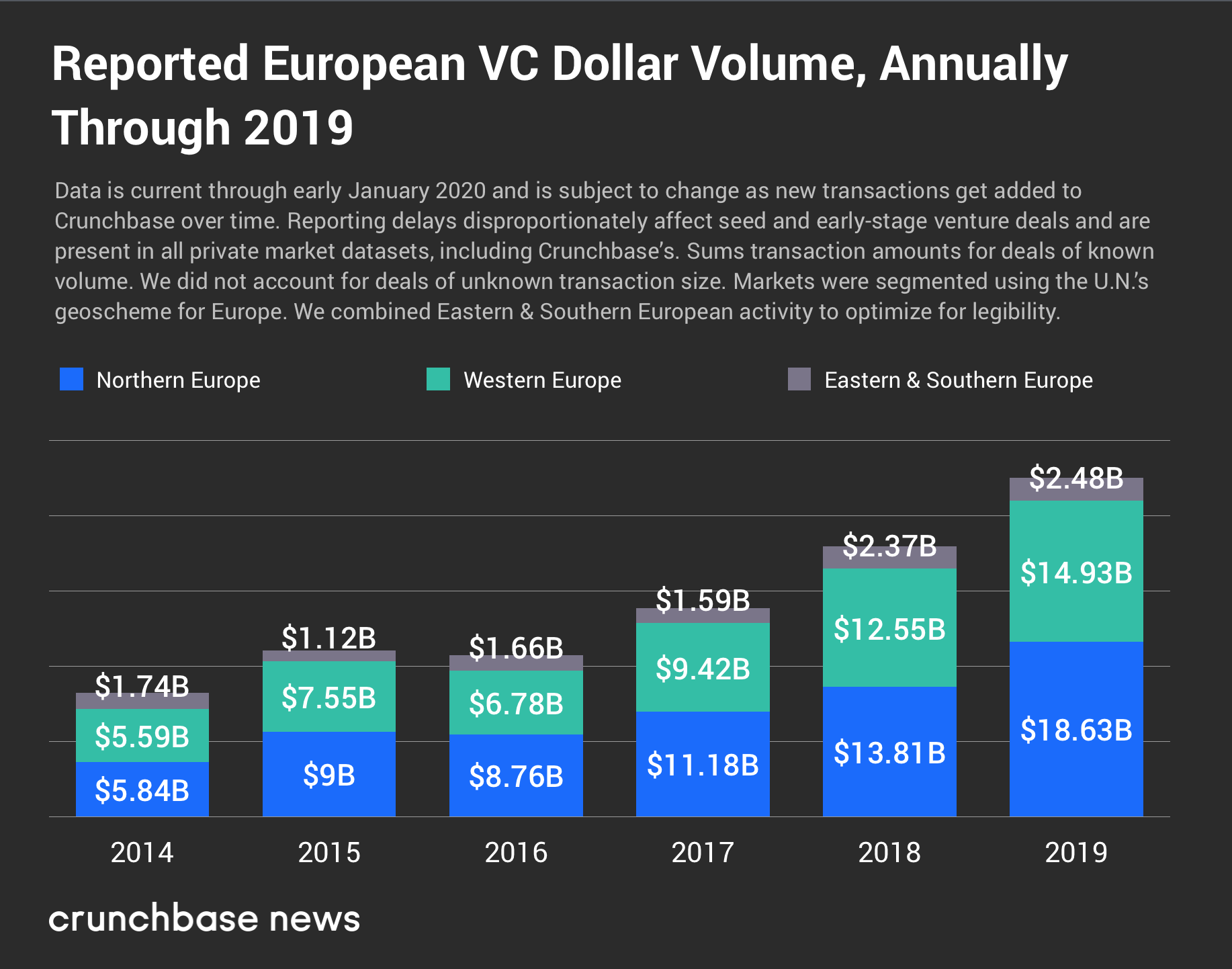

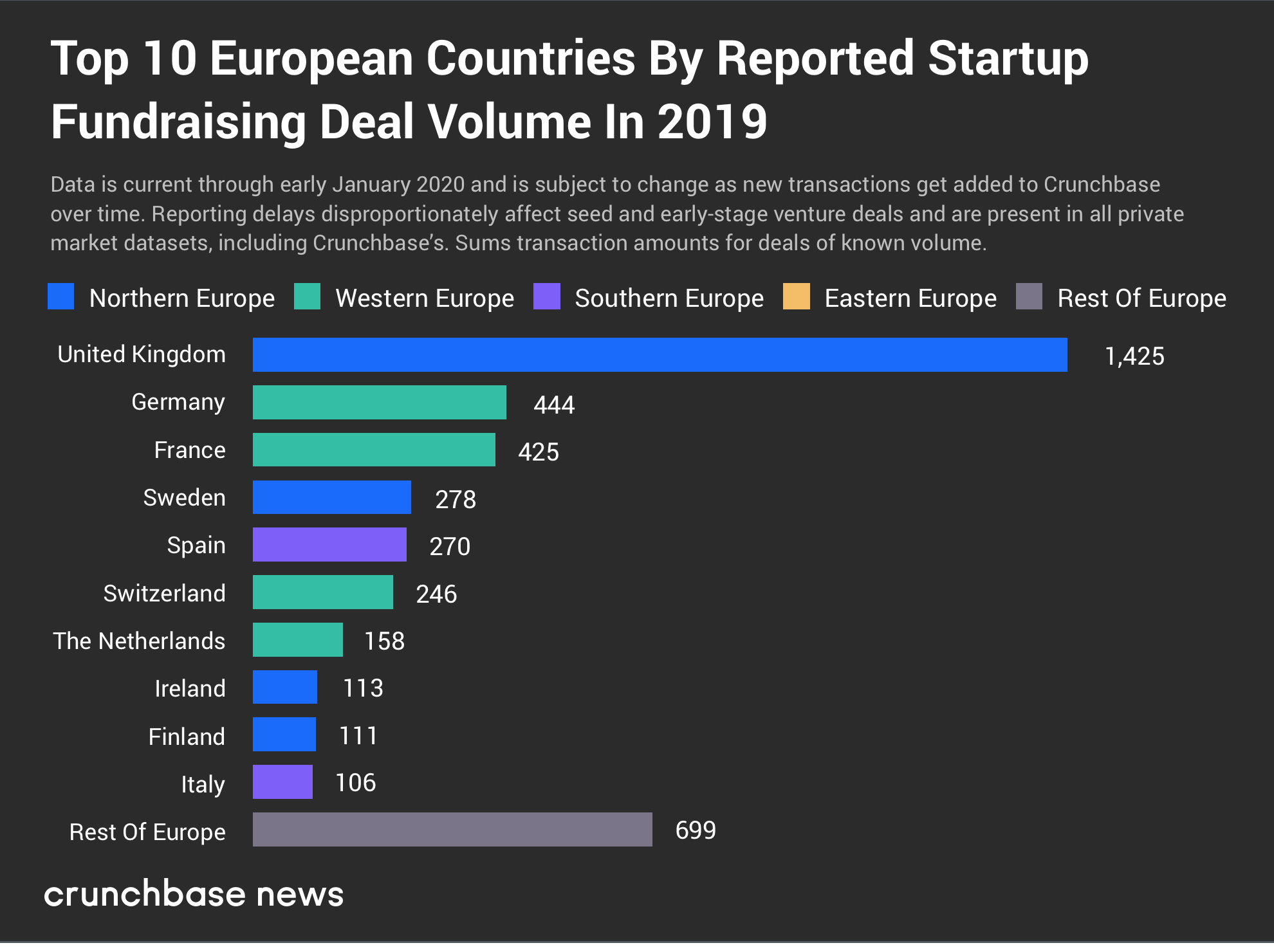

Northern Europe, which Crunchbase News defines as including the United Kingdom, Nordic countries, Lithuania, Latvia and Estonia, pulled in the majority of that amount–$18.63 billion to be exact. The U.K. can take credit for that, as it led the region in deal and dollar volume for the past year. Sweden, also part of Northern Europe, is the fourth-largest country for European funding rounds in 2019.

Western Europe raised $14.9 billion in 2019. Western Europe includes Germany, France and Switzerland–three countries in the top six by funding counts and amounts.

Eastern and Southern Europe, which includes Spain (in the top six), Italy and Poland raised $2.5 billion in funding in 2019.

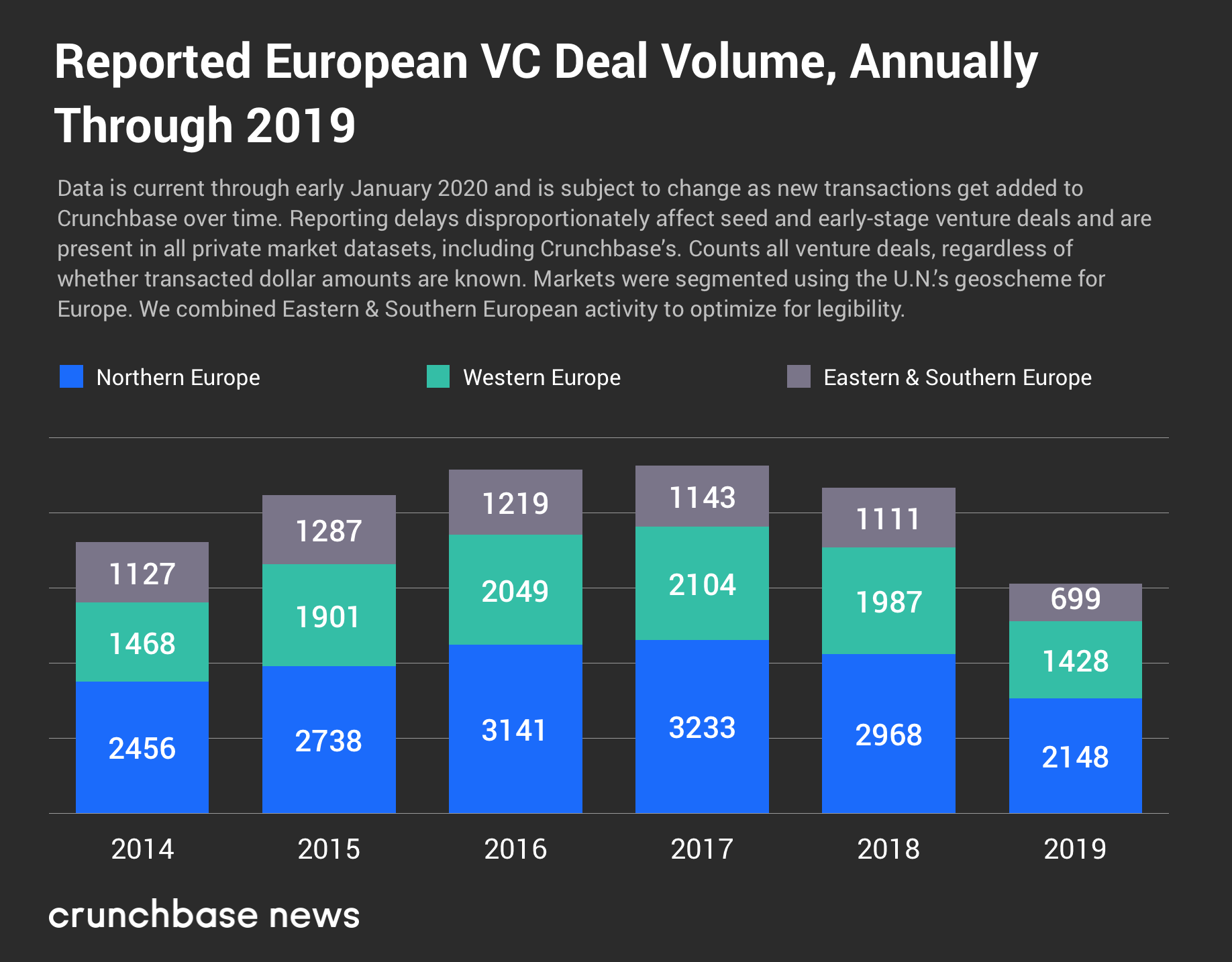

Year-over-year deal counts could be perceived to be down. However, early-stage deal counts–Series A and B–are on par at 1,000 rounds for both 2018 and 2019, with later-stage venture deal counts up by 16 percent year over year. With much of the difference in funding round counts attributed to the seed stage, where we see the most reporting delays, we fully expect these numbers to go up during 2020. Reporting delays for funding amounts are less pronounced in Crunchbase data.

In terms of deal volume, the United Kingdom took first place by far, with 1,425 deals totaling $14.31 billion in 2019, representing 40 percent of European funding in 2019. Germany was the runner-up, with 444 deals adding up to $6.65 billion (18 percent) last year. France wasn’t far behind Germany, with 425 deals totaling $4.39 billion (12 percent) in 2019.

The largest venture funding round for 2019 was London’s OneWeb, which raised $1.25 billion in March in a round led by Softbank–also the only VC round for a European company that was over $1 billion, according to Crunchbase. London’s Deliveroo took second place with its $575 million Series G, and Germany’s Flixbus took third place with its €500 million (approximately $555 million) Series F.

Investors In European Startups

Let’s take a look at the firms that are most active in European startups at each stage–seed, early- and late-stage venture.

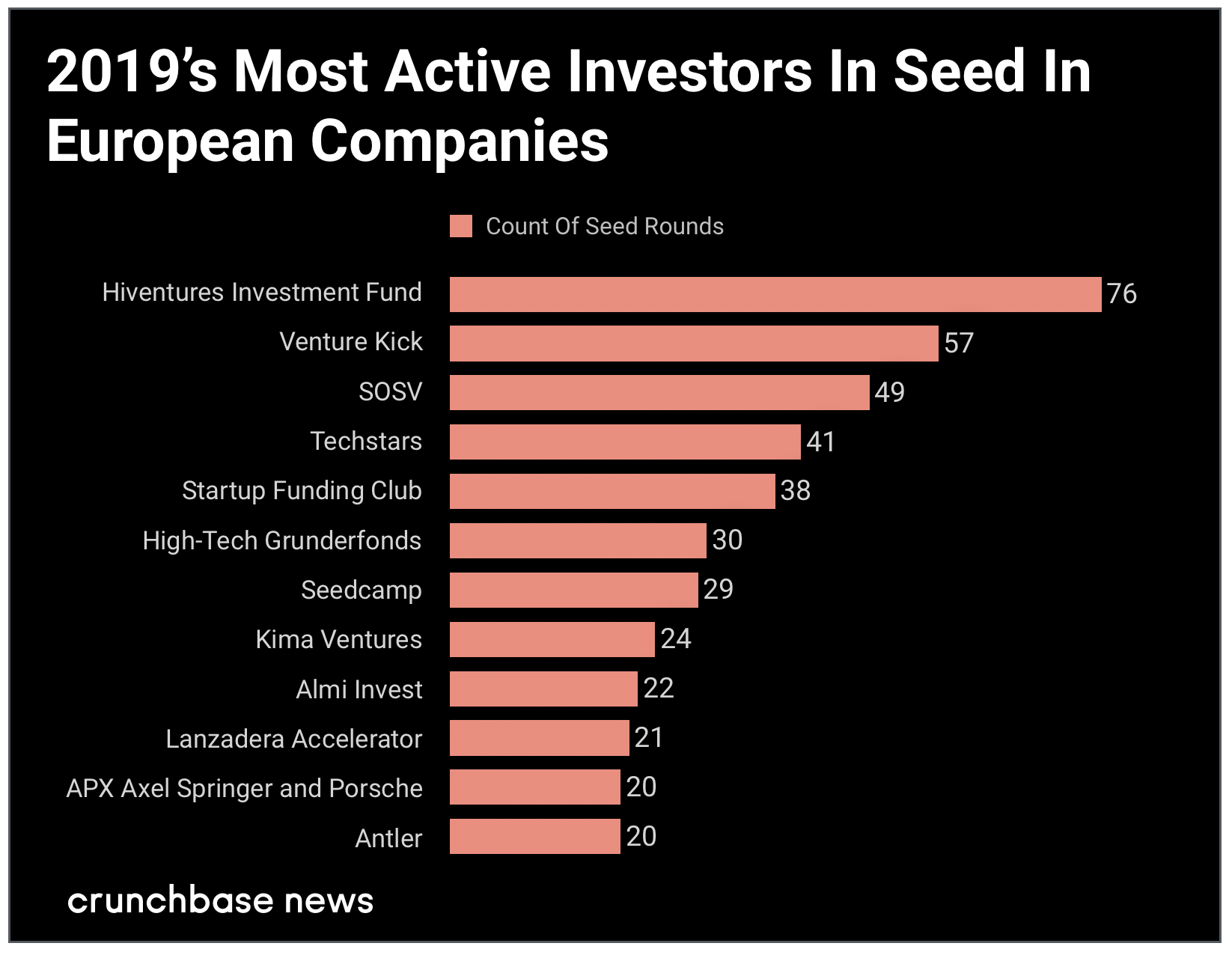

The investors at the seed stage in European startups represent a mix of pre-seed/accelerator funds typically investing below $100,000 along with seed funds investing around $500,000 to $3 million.

The leading pre-seed stage investors include Hiventures Investment Fund, a Hungarian state-owned venture fund and Venture Kick from Switzerland, which provide pre-seed funding to entrepreneurs from Swiss Universities. SOSV and Techstars are global accelerators with Europe-based accelerator programs. Startup Funding Club is a U.K.-based business angels club.

Germany-based High-Tech Grunderfonds, Seedcamp in the U.K., and Kima Ventures in France are all among the most active seed-stage investment funds leading the larger seed rounds.

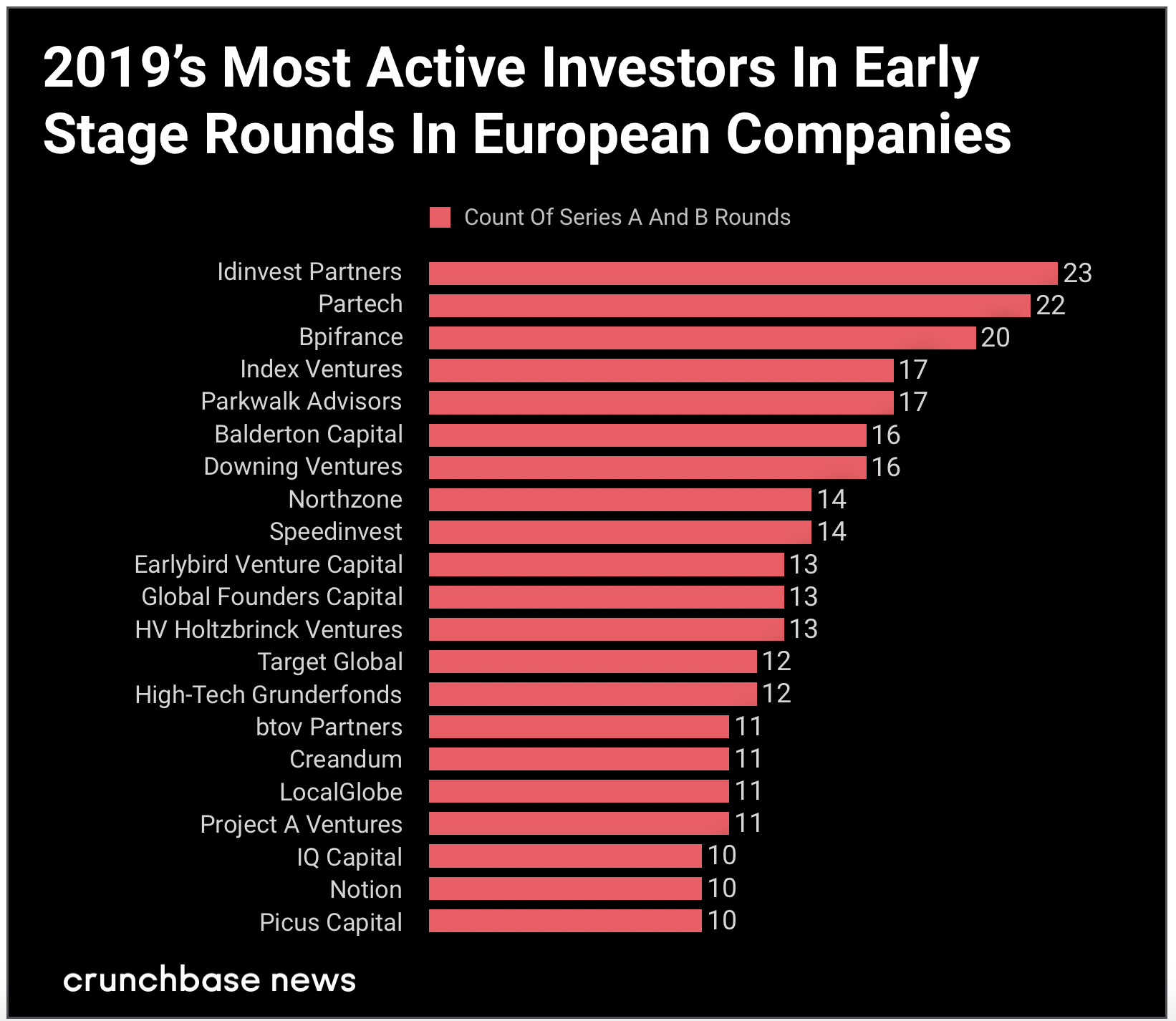

Active early stage investors (Series A and B rounds) in 2019 include Idinvest Partners, Partech and Bpifrance, which are all based in France. The next set of investors, Index Ventures, Parkwalk Advisors, Balderton Capital and Downing Ventures are all U.K.-headquartered firms. Northzone is in Sweden and Speedinvest is in Austria. Earlybird Venture Capital, Global Founders Capital and HV Holtzbrinck Ventures are all based in Germany.

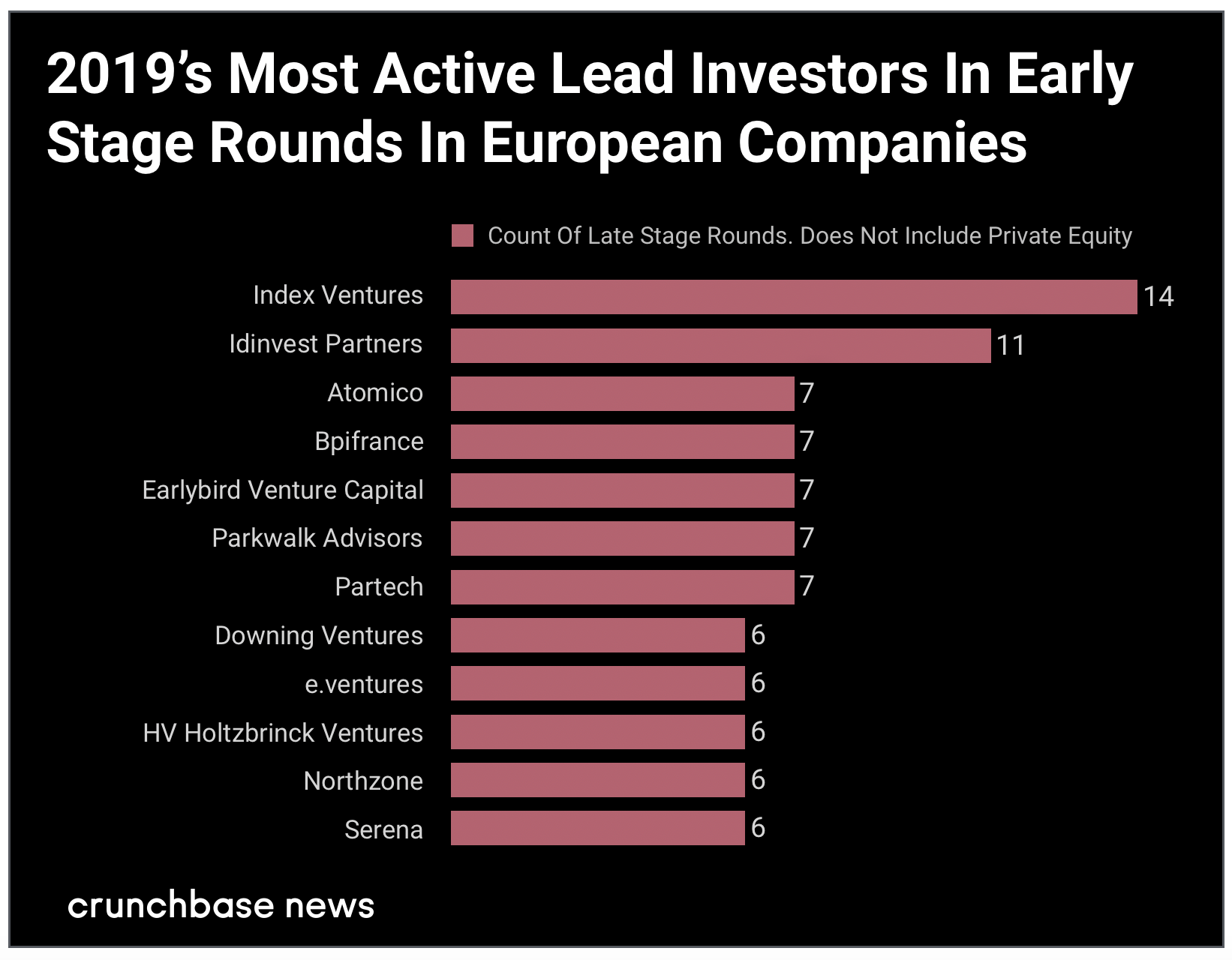

When viewed by investors leading Series A and B rounds, a few new venture investors rise to the top 12 namely Atomico (U.K.) , e.ventures (U.S.) and Serena (France).

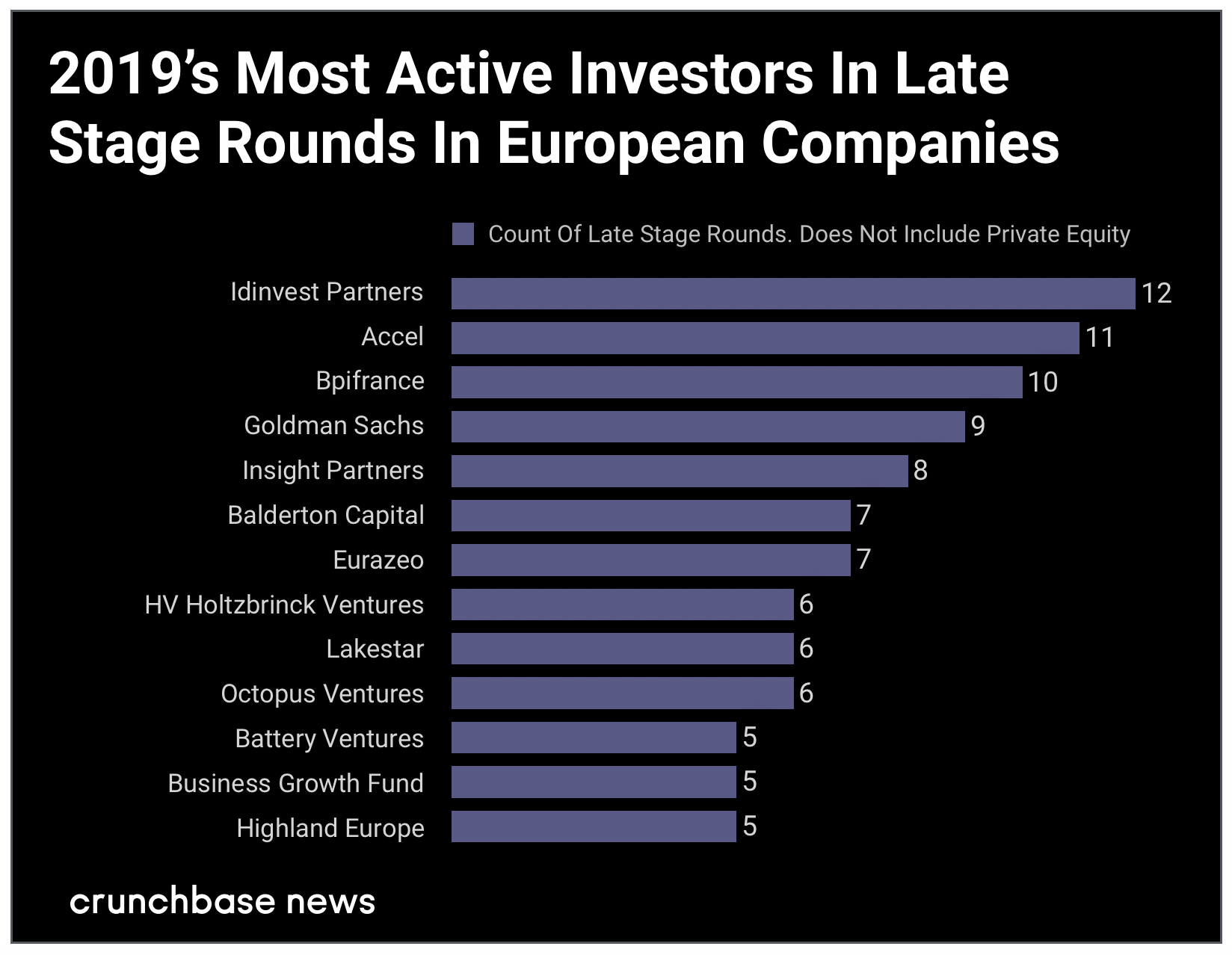

The most active investors in late-stage rounds include European and global players. Late-stage rounds are comprised of Series C+ rounds, as well as venture rounds above $15 million. Firms not previously mentioned include Accel, a U.S.-based venture firm with a well-established London office celebrating 20 years this year.

Firms in this list that lead at late stage are Goldman Sachs, an investment banking firm, and Insight Partners which invests in growth-stage startups. Both are headquartered in New York. Eurazeo a PE and venture firm based out of Paris also leads late-stage rounds.

“An important development we saw this year is that the outside world now also shares our homegrown belief in European tech,” said Tom Wehmeier, a partner and head of research at Atomico. “Twenty-one percent of all rounds in Europe this year involved participation from a U.S. or Asian investor. That’s doubled since five years ago. This funding is especially important in later-stage funding deals.”

“There is certainly more availability of capital in Europe now,” said Luciana Lixandru a partner at Accel in London commenting on what has changed in the European funding ecosystem. “Ten years ago there was this stereotype that European founders are not ambitious enough. This is no longer the conversation.”

According to Wehmeier and reflected in this report “We’re seeing the successes of the first generation of European tech startups become a platform for even greater success. This matters because you need three things to have a tech ecosystem: talent, capital and belief. The first generation of successes has birthed talent and is attracting more and more capital from Europe-specific funds. But continued successes have also made people believe in the potential of this ecosystem. Belief is what helps people with great ideas today become the founders of tomorrow. It’s what makes people give up the security of a well-paid corporate job for the unpredictability of startup life. And it shapes capital allocation and investment.”

The increase in funding in 2019 to European startups is visible at all stages. And with many firms active in venture, we see a robust ecosystem developing across Europe.

Methodology

For the regional divisions, we relied on the United Nations Geoscheme for Europe, which is produced by the United Nations Statistics Division. Information about the Geoscheme can be found on Wikipedia or on the website of the UN Statistics Division

Please note that all funding values are given in U.S. dollars unless otherwise noted. Crunchbase converts foreign currencies to U.S. dollars at the prevailing spot rate from the date funding rounds, acquisitions, IPOs and other financial events as reported. Even if those events were added to Crunchbase long after the event was announced, foreign currency transactions are converted at the historic spot price.

Analysis is based on data in Crunchbase as of Jan. 7, 2020.

Glossary of Funding Terms

- Seed/Angel include financings that are classified as a seed or angel, including accelerator fundings and equity crowdfunding below $5 million.

- Early-stage venture includes financings that are classified as a Series A or B, venture rounds without a designated series that are below $15 million and equity crowdfunding above $5 million unless otherwise noted.

- Late stage venture includes financings that are classified as a Series C+ and venture rounds greater than $15 million.

- Note: Fundings denoted by Crunchbase as corporate rounds or private equity are not included in this report. In some instances, this will impact totals to a significant degree.

Illustration: Dom Guzman