Global VC Report 2020: Funding And Exits Blow Past 2019 Despite

Pandemic Headwinds

By Gené Teare for Crunchbase Daily

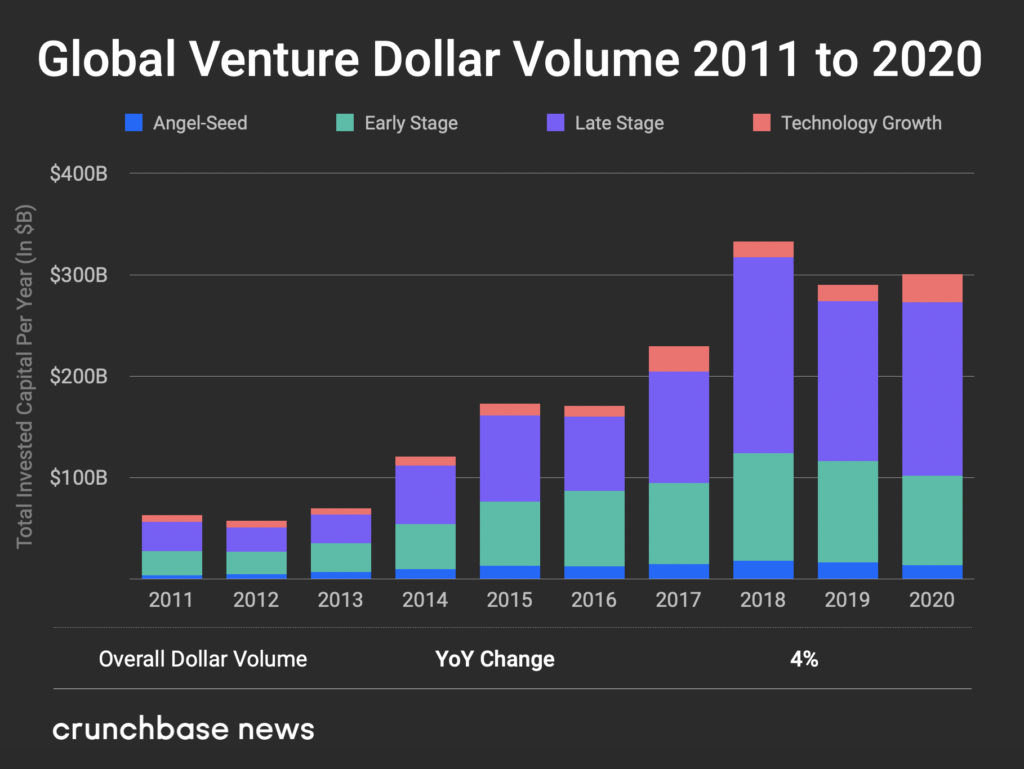

Startups closed out 2020 in a much stronger position than the one they started the year in, with global venture funding up 4 percent year over year to $300 billion. That growth came as industries disrupted by the global pandemic—work, health care, education, finance, shopping and entertainment—shifted dramatically to online services. That, in turn, created a boom for tech infrastructure and cloud services companies supporting this transfer, leading to a strong IPO and M&A market as companies sought to consolidate and compete.

The tech boom was led by the largest companies in the space, with Apple hitting a valuation of more than $2 trillion in August for the first time, and Amazon and Google cresting $1 trillion.

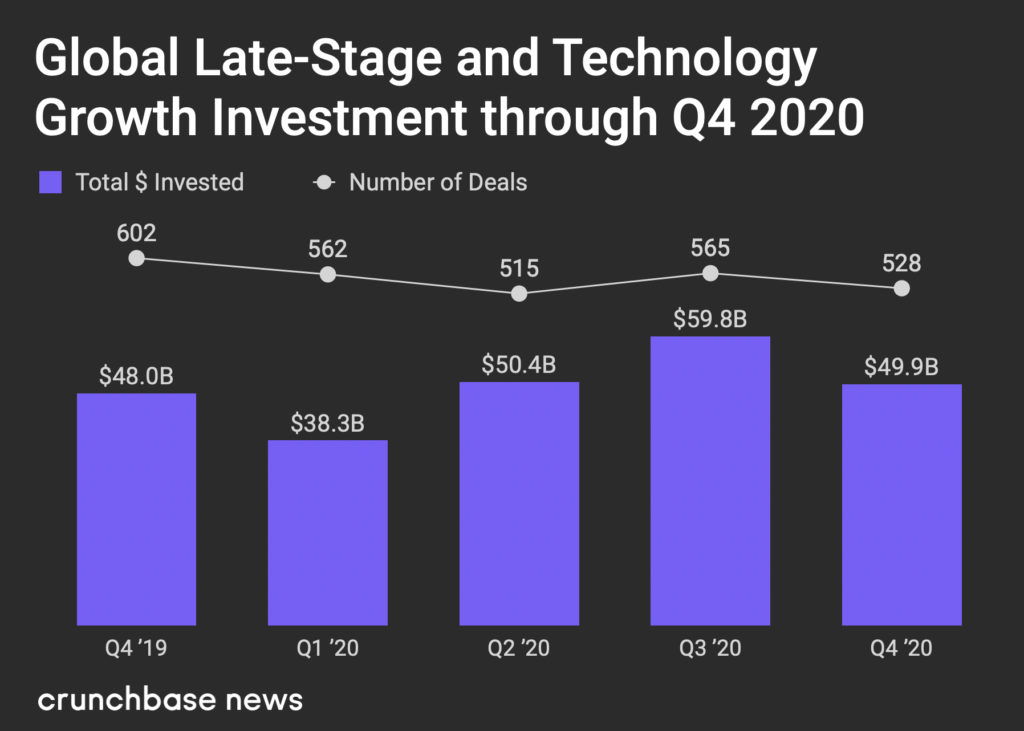

In the private markets, their smaller counterparts followed suit, particularly when it came to later-stage funding. Late-stage venture capital, which includes Series C and later rounds, grew 8 percent year over year. Private equity in venture-backed companies grew even more, at 73 percent year over year.

Table of Contents

- Seed funding

- Early-stage funding

- Late-stage and technology growth

- M&A

- Decacorn valuations in the public markets

- Conclusion

- Methodology

- Glossary of funding terms

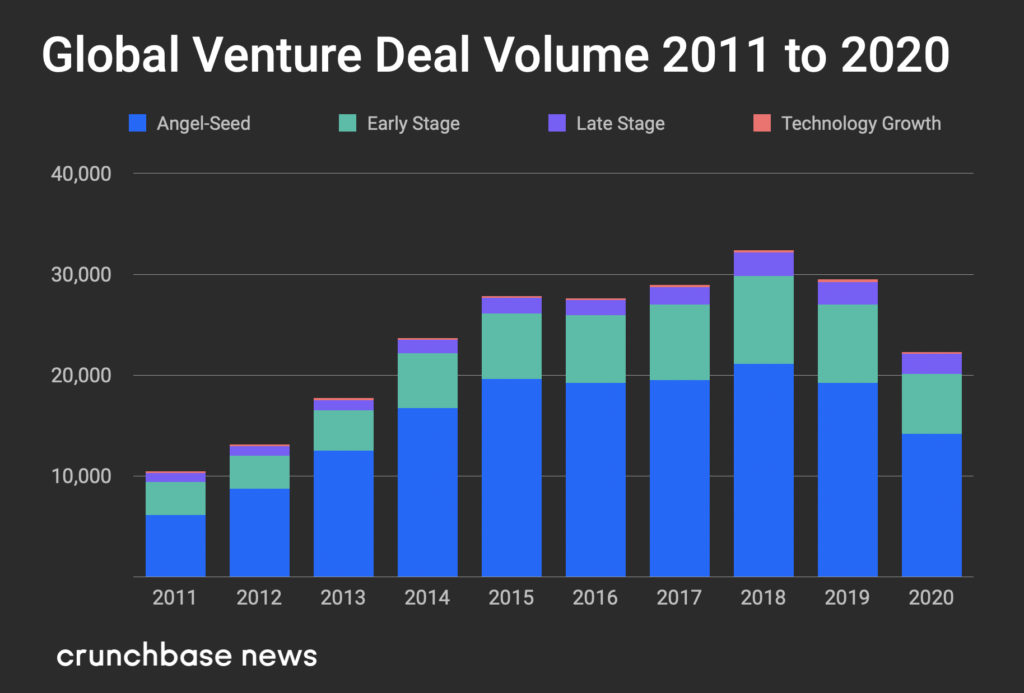

Deal volume has grown significantly through the decade, from just over 10,000 rounds from seed through to late-stage mega rounds in 2011 to close to 30,000 rounds since 2017. Funding counts were not necessarily down year over year for 2020 as a large percentage of seed funding is added over time by founders.

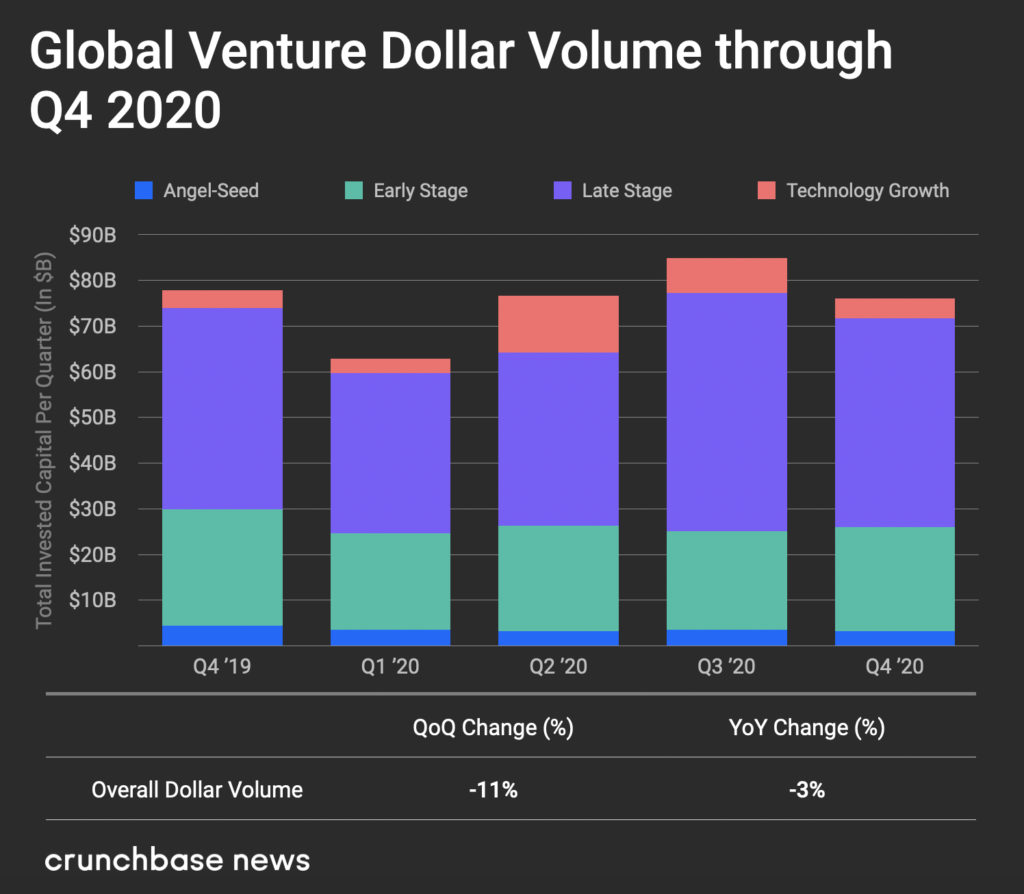

Funding in the fourth quarter slowed down 11 percent from a strong third quarter—the highest quarter over the past two years—and down a few percentage points year over year.

Looking back over 2020, we find that the first quarter was the most impacted by the pandemic, but by late March the funding pace had picked back up, per Crunchbase data.

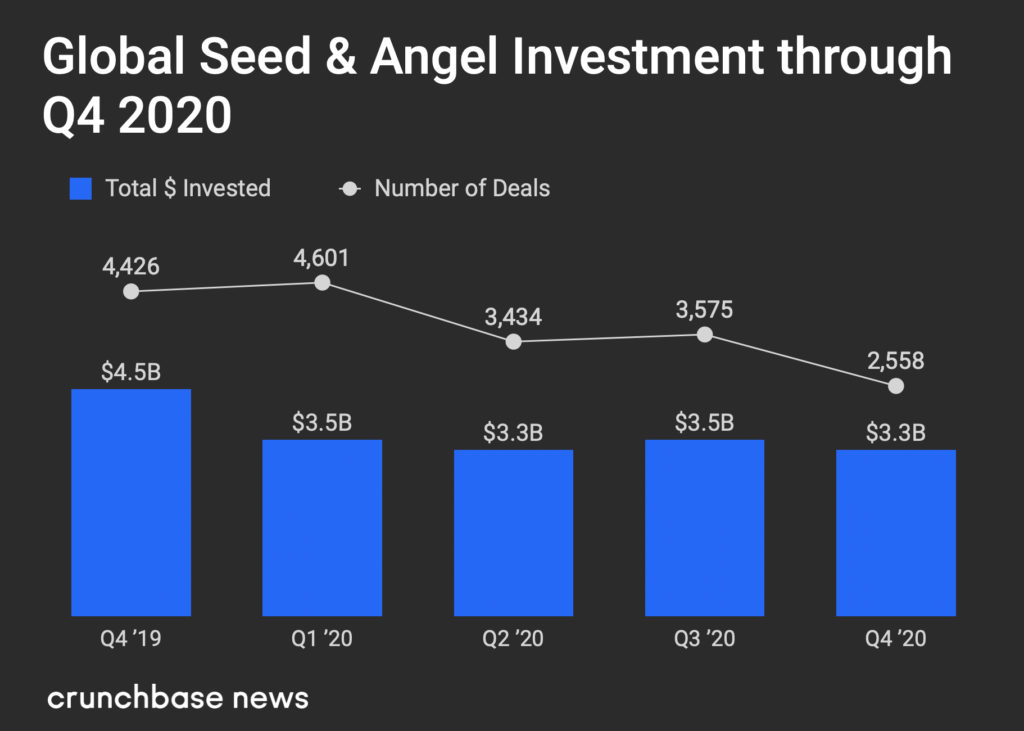

Seed funding

At $3.3 billion, seed funding in the fourth quarter was down 27 percent year over year and 7 percent quarter over quarter. (Note that data lags for seed funding are the most pronounced, so these percentages will likely come down over time.)

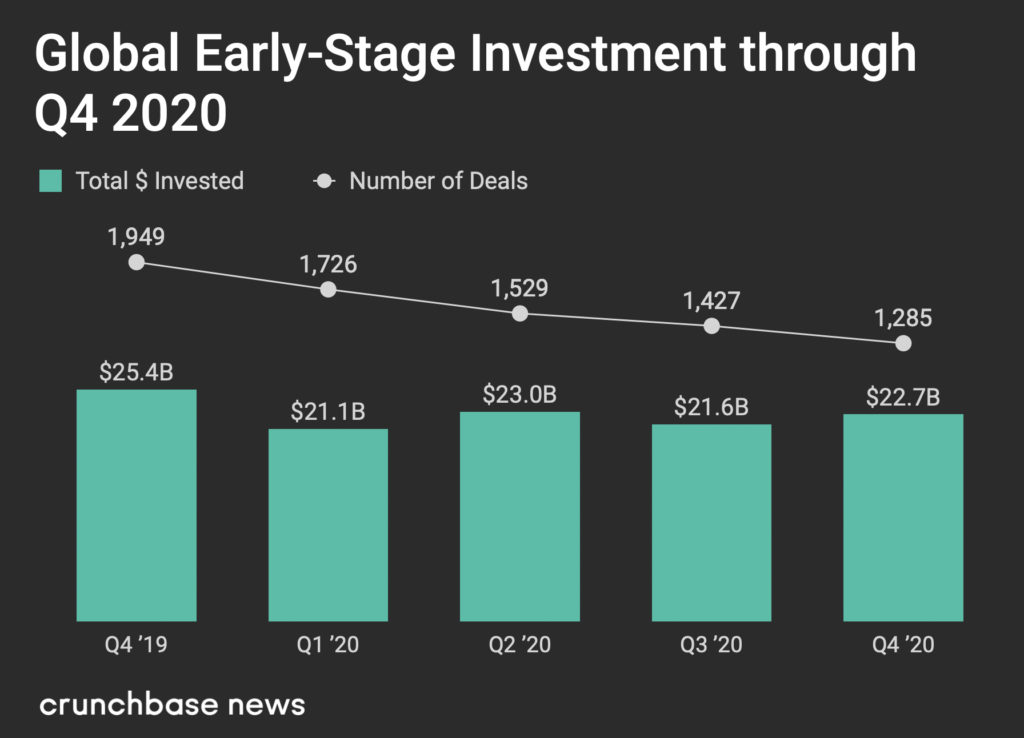

Early-stage funding

Early-stage funding totaled $22.7 billion in the fourth quarter, down 11 percent year over year but up 5 percent quarter over quarter. Overall, early-stage venture in 2020 was down 11 percent compared to 201

Late-stage and technology growth

Late-stage and technology growth funding came in just under $50 billion in the fourth quarter, up year over year by 4 percent but down quarter over quarter by 16 percent.

M&A

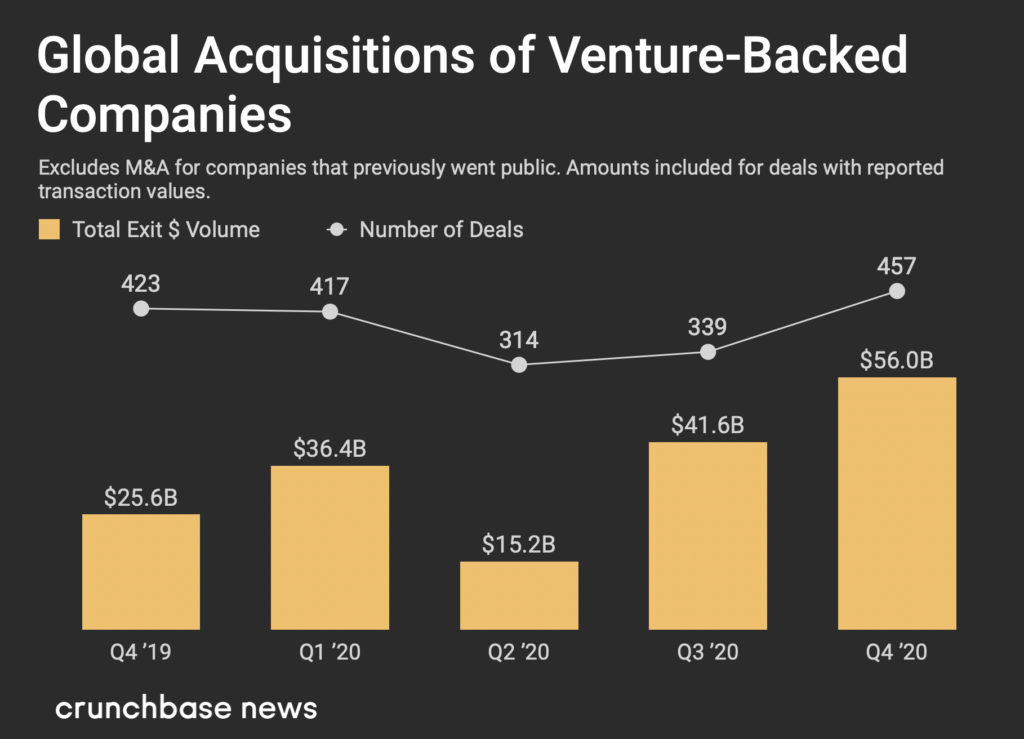

Last year, 41 venture-backed companies were acquired for more than $1 billion, selling for $104 billion collectively. That was the highest count and amount for billion-dollar exits over the past decade, with 2018 notching the second-highest record at 31 companies acquired for a total of $95 billion.

All told, more than 1,500 companies were acquired for $149 billion by more than 1,300 acquirers in 2020. (For this analysis on returns, we excluded M&A for companies that previously went public.)

The most active acquirers in 2020, according to Crunchbase data, were Apple, Microsoft and Cisco. The largest acquisition of the year was for business cloud software provider Infor, which was acquired by Koch Industries for $13 billion, but will remain an independent entity serving its 68,000 customers.

In the fourth quarter, acquisitions in cybersecurity, customer engagement, scheduling, supply chain management, business cloud and food delivery all stand out in billion-dollar deals.

Decacorn valuations in the public markets grow

Airbnb and DoorDash were the two most highly valued venture-backed companies to go public via IPOs in 2020 and did not disappoint. Airbnb went public at a valuation of $47 billion and as of Jan. 8, 2021 is trading at close to double that valuation. DoorDash went public at $39 billion and is currently up more than 50 percent.

All told, 13 venture-backed companies debuted at a valuation above $10 billion in 2020, marking the highest count in the last decade. There were a total of 16 public market debuts above $10 billion in the prior nine years.

Sequoia Capital is the standout investor of the year from an exit perspective. It was an early investor in Airbnb, DoorDash and Unity Technologies. Sequoia Capital invested in five other companies at Series C or later that went public above $1 billion in 2020. The firm also invested in three companies that were acquired for more than $1 billion in 2020.

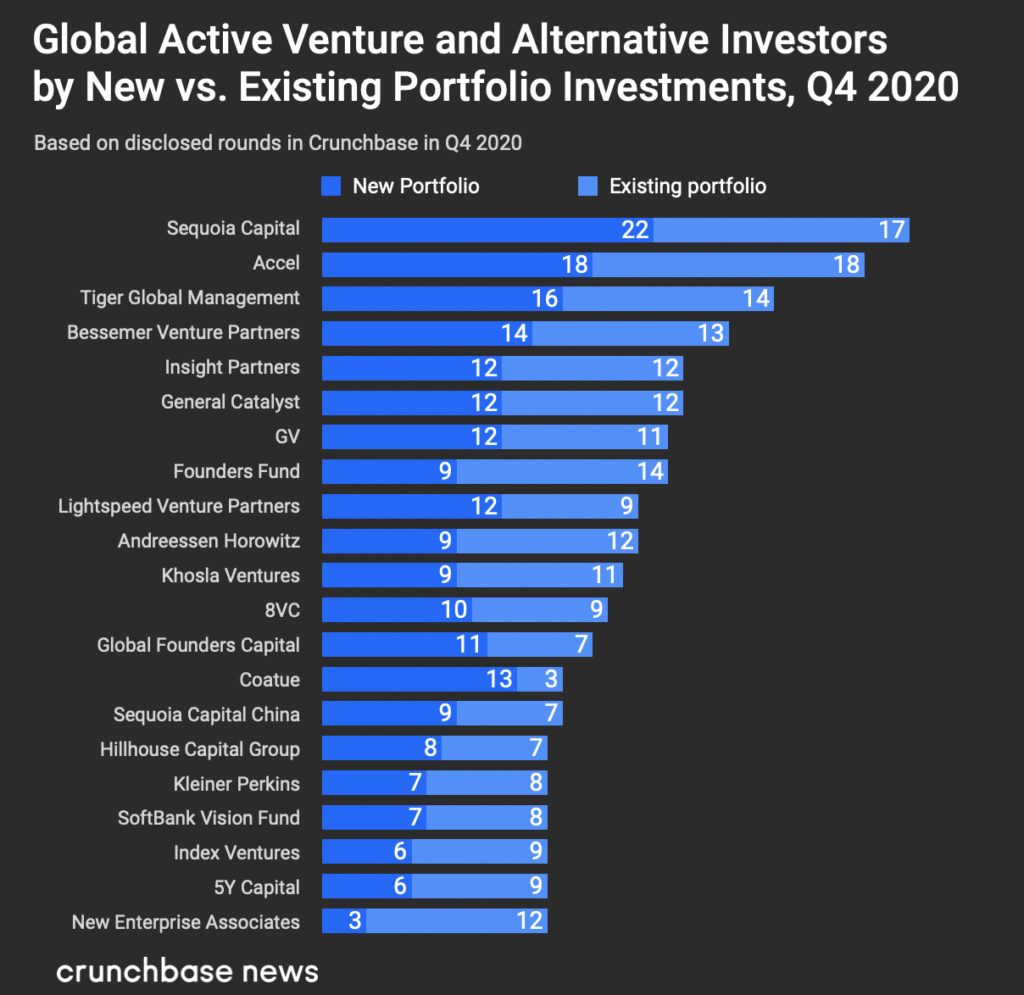

Sequoia, Accel and Tiger Global Management led the funding pace in the fourth quarter of 2020 with new investments at or exceeding the number of follow-on investments.

GV was the most active corporate investor. Among the most active funds headquartered in China were Sequoia Capital China and 5Y Capital. Other active funds headquartered outside of the U.S include Global Founders Capital from Germany, and Softbank Vision Fund headquartered in the U.K.

Of the 20 most active investors in private companies, five are alternative or private equity investors.

The most active investor over the whole of 2020 was Accel with 114 investments, followed by Sequoia Capital. (Note: Sequoia Capital China and Sequoia Capital India are included separately in the top 20 global active investors.) Andreessen Horowitz, Global Founders Capital and Lightspeed Venture Partners round out the top five most active investors in 2020.

In conclusion

With the vaccine finally here and working toward mass distribution in 2021, life will slowly shift back to being closer to how it was before the pandemic.

While the concern for many online services may be that adoption will slow as we return to schools and offices, the investment that business has made into digital transformation and the efficiencies that benefit consumers will not go away.

Last year was a milestone year. With cloud and mobile computing well over a decade in the making, and 5G on the horizon—creating an order of magnitude improvement in network speed—we ask what technologies will the next wave deliver? Will the next decade create the productivity gains and automation that technology promises? Will we improve the standard of living globally? As whole industries continue to be transformed, it is going to be interesting to watch.

Methodology

The data contained in this report comes directly from Crunchbase, and is based on reported data. Data reported is as of Jan. 6, 2020.

Note that data lags are most pronounced at the earliest stages of venture activity, with seed funding amounts increasing significantly after the end of a quarter/year.

The most recent quarter/year will increase over time relative to previous quarters. For funding counts, we notice a strong data lag, especially at the seed and early stages, by as much as 26 percent to 41 percent a year out.

Please note that all funding values are given in U.S. dollars unless otherwise noted. Crunchbase converts foreign currencies to U.S. dollars at the prevailing spot rate from the date funding rounds, acquisitions, IPOs and other financial events are reported. Even if those events were added to Crunchbase long after the event was announced, foreign currency transactions are converted at the historic spot price.

For M&A transaction analysis, we include venture-backed companies and exclude companies that previously went public.

Glossary of funding terms

Seed and angel consists of seed, pre-seed and angel rounds. Crunchbase also includes venture rounds of unknown series, equity crowdfunding and convertible notes at $3 million (USD or as-converted USD equivalent) or less.

Early-stage consists of Series A and Series B rounds, as well as other round types. Crunchbase includes venture rounds of unknown series, corporate venture and other rounds above $3 million, and those less than or equal to $15 million.

Late-stage consists of Series C, Series D, Series E and later-lettered venture rounds following the “Series [Letter]” naming convention. Also included are venture rounds of unknown series, corporate venture and other rounds above $15 million.

Technology growth is a private-equity round raised by a company that has previously raised a “venture” round. (So basically, any round from the previously defined stages.)

Illustration: Dom Guzman