Venture capitalist Jennifer Neundorfer gave me (quite possibly) the quote of the year when we spoke in October. When describing her firm, Jane VC, and its focus on female founders, she said:

Subscribe to the Crunchbase Daily

Let’s just have that sink in for a minute. It’s not about gender, it’s about being a capital-focused operation, comprised of investors wanting returns. Nothing more, nothing less.

While the 2019 stories of Glossier and Rent The Runway and The RealReal were all important amplifiers of the prowess and strength of female founders, underneath it all stands another perspective: diversity-focused funds weren’t innately impact-focused funds.

And as the year comes to a close, Crunchbase data shows what ‘overperforming’ really means: 2019 has been a historic year for female-founded unicorns, which were born at an unprecedented pace.

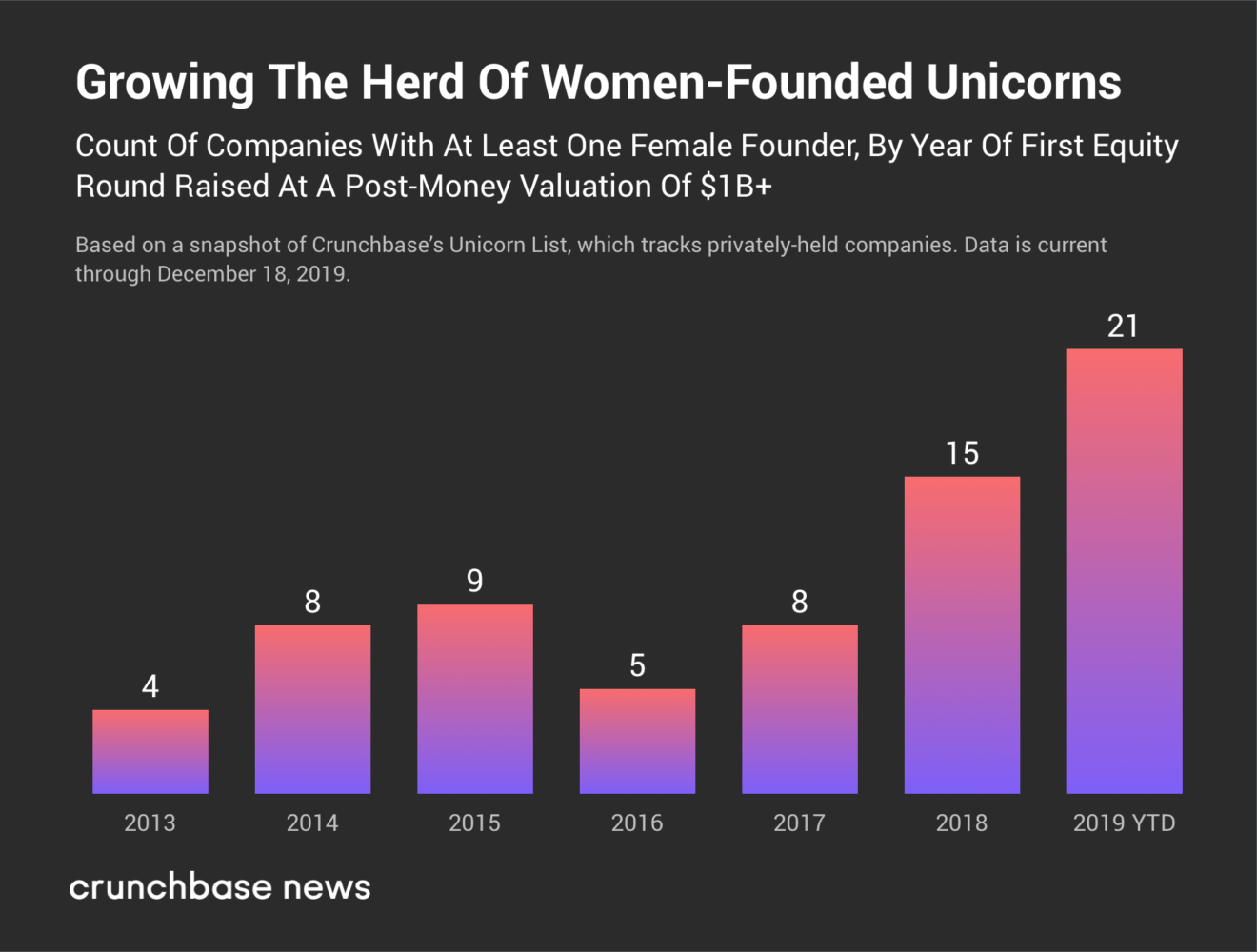

For context, in 2018 there were 15 unicorns born with at least one female founder. This year, there were 21 startups founded or co-founded by a female that became unicorns. The chart below shows how many companies with at least one female founder passed the $1 billion in valuation mark each year, starting in 2005.

The Companies

When we talked to beauty company Glossier founder Emily Weiss, she said, “Beauty wasn’t a category that many [venture] firms were interested in exploring.” She added “then 2018 came, and it was a record year for venture funding in the beauty industry.”

She bet that 2019 might break the record again, and was proven right in a few ways as companies in beauty and commerce also landed billion dollar valuations (think FabFitFun and The RealReal).

Beyond beauty and commerce, female founded and co-founded unicorns born this year include Hims, Airwallex, ezCater (which we covered previously), and Scale.

While it’s easy to be distracted by skyrocketing valuations, it’s worth noting that these companies are not immune from weaknesses and mistakes.

For example, 2019 unicorn Away was co-founded by Jen Rubio and Steph Korey, and recently was exposed for abusive management styles and working conditions from The Verge. Korey has since resigned, and former Lululemon COO and CFO Stuart Haselden took over as a chief executive alongside Rubio.

But let’s circle back to the broader issue at hand. Before these companies had to convince investors they had a $1 billion dollar idea, they had to convince the same cohort to cut a check in the first place. And that brings me to the story of Shani Dowell.

A Historic Fundraise In Tennessee

Shani Dowell just raised $1 million in funding for her Tennessee-based edtech platform, Possip. We typically wouldn’t cover a funding round so small, except hers is historical: the company claims that Dowell is the first black woman in Tennessee to raise more than $1 million in venture funding.

Nationally, less than 2 percent of all venture funding goes to companies led by women, and .006 percent to companies led by black women, according to the company.

Dowell’s fundraise is both a sign of progress and lack thereof, which is similar to the greater data pulls we get when we unpack diversity. For example, while female-founded unicorns are being born at an unprecedented pace, they only make up 4 percent of startups that reached a valuation of $1 billion or more in 2019.

Adding onto that, female-only founded teams are only raising $3 dollars for every $100 spent, according to Crunchbase data.

But Dowell’s story provides a glimmer of hope. She got her start through the Nashville Entrepreneurial Center. This fact may support the idea that emerging programs and institutions are working, albeit slow. And the data around female-founded unicorns shows us that these companies, from an investor side, are far from a charity case, they’re vehicles for returns.